Planned Giving

You already have an estate plan.

It’s a plan by default, a government plan—but have you considered planned giving?

Governments do not know or care who we are: our faith, our principles, our ethics, our achievements, or our devotion to our families. In the government plan, hard-earned assets can be unnecessarily taxed, leaving heirs or charities we care about with little or nothing.

The only way to ensure that your legacy plan reflects your vision and priorities is to design it yourself, with the help of financial and legal counsel.

You have the power to protect what God has entrusted to you and direct your estate in a way that preserves your values. Careful planning can protect you from income erosion due to capital gains taxes, increase spendable lifetime income, and honor your family.

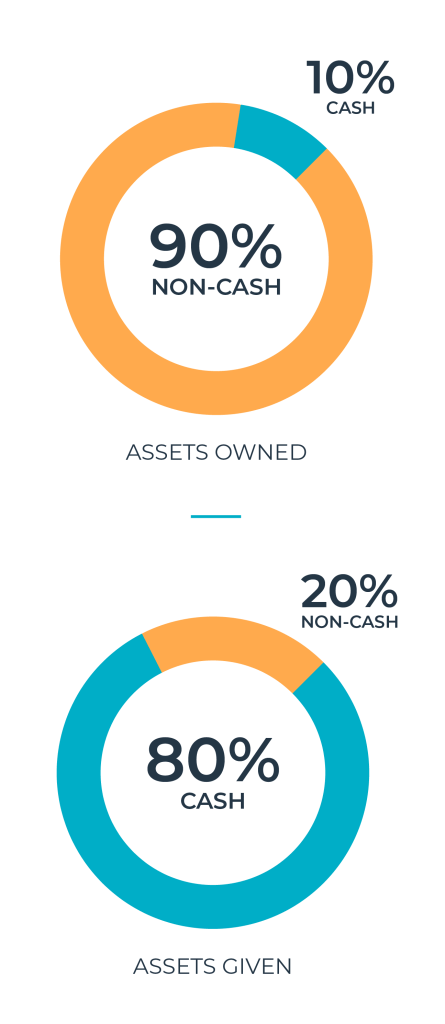

Remarkably IRS statistics show that most people give from cash, even though most of their wealth is held in non-cash assets*. Planned Giving allows people to give from their assets as well as setting up other ways to give using annuities, insurance, estate planning, and business profits. Our goal is to help you understand the options you have when making decisions about planned giving.

Watch as Lifesong Board Member, Tim Wallen, shares about the options you have to make a lasting impact with planned giving.

Ways to Give

There are many ways to plan your giving, so we’ve compiled some helpful information from highly recommended financial advisors of Ron Blue Trust, and The National Christian Foundation.

Gifts of Stock

Many people who own stocks or shares in mutual funds have watched the value of their investments increase. But now they face a problem – how to turn their investments into cash without losing a large portion of their gains to taxes. One answer is to donate all or a portion of your investment to charity. LEARN MORE

Life Insurance Policy Gifts

Life insurance is a practical and affordable way for you to do more than you may have thought possible. Gifts of $50,000, $100,000, $500,000 and even more are within reach. Donors no longer need to accumulate great wealth to make substantial and meaningful gifts. LEARN MORE

Establish A Will

Every adult should have a will to provide for their family and loved ones upon their death. Otherwise, state law will determine how assets are distributed — and that might not be in accordance with your wishes and sometimes creates extra expenses and taxes. LEARN MORE

Giving Real Estate

Giving a charitable gift of real estate is an option for owners of farmland, commercial or residential rental property, or vacant investment land. LEARN MORE

Donor-Advised Fund

A donor-advised fund is a smart, powerful, simple way to manage your charitable giving and is a more effective alternative to direct-to-charity giving or using a private foundation. LEARN MORE

Give An IRA

If you have a traditional IRA, you already know it can be a powerful vehicle for accumulating tax-deferred savings. But did you know that by donating it to charity at your death, you can avoid paying substantial taxes that would be due? LEARN MORE

Farm Commodities

Farming presents special opportunities to make donations to charity and reduce your taxes. You can give gifts of grain, livestock, equipment, etc. Not only do charities benefit, but you can deduct the cost of production and you may qualify for other tax benefits as well. LEARN MORE

Charitable Gift Annuities

A Charitable Gift Annuity (CGA) is a simple concept: an arrangement that involves a charitable gift and an annuity. You make the gift (part of which is tax-deductible), and then you receive fixed annuity payments each year for the remainder of your life. LEARN MORE

Business owner, Rich Gramm, explains how giving through NCF is a powerful tool to help impact God’s Kingdom.

Lifesong board member, Bob Hoerr, discusses leaving a lasting legacy through planned giving.

I want to learn more about planned giving and how it can be strategic for me and my family.

"*" indicates required fields

After submitting this form, a Lifesong staff member will be in touch to connect you with world-class experts that can help you plan.